carried interest tax loophole

Carried interest allows hedge funds to evade their tax obligations. This is a loophole that should absolutely be closed.

This creates a controversy that carried interest is a tax loophole.

. All of these types of investment firms have been accused of victimizing the public evading their tax obligations and benefitting from a preferential tax treatment. Several Republican senators suggested they may be on board with eliminating some business tax loopholes. Many politicians want to close the carried interest tax loophole for private equity managers.

The tax code is broken and this is a primary example of why we need to fix it. July 15 2016. If the fund manager receives a 20 carried interest in exchange for managing investors capital of 100 million and the prescribed interest rate for the tax.

Managers are compensated through a flat 2 management fee and a 20 performance fee. 14 2018 1144 am ET. Critics argue that this is a tax loophole since portfolio managers get paid from that money which is not taxed as income.

The carried interest loophole allows fund managers to benefit from profits made by putting other peoples money at risk as if it were their own. The carried interest tax loophole is an income tax avoidance scheme that allows private equity and hedge fund executives some of the richest people in the world to substantially lower the amount they pay in taxes. The only problem is no such loophole exists.

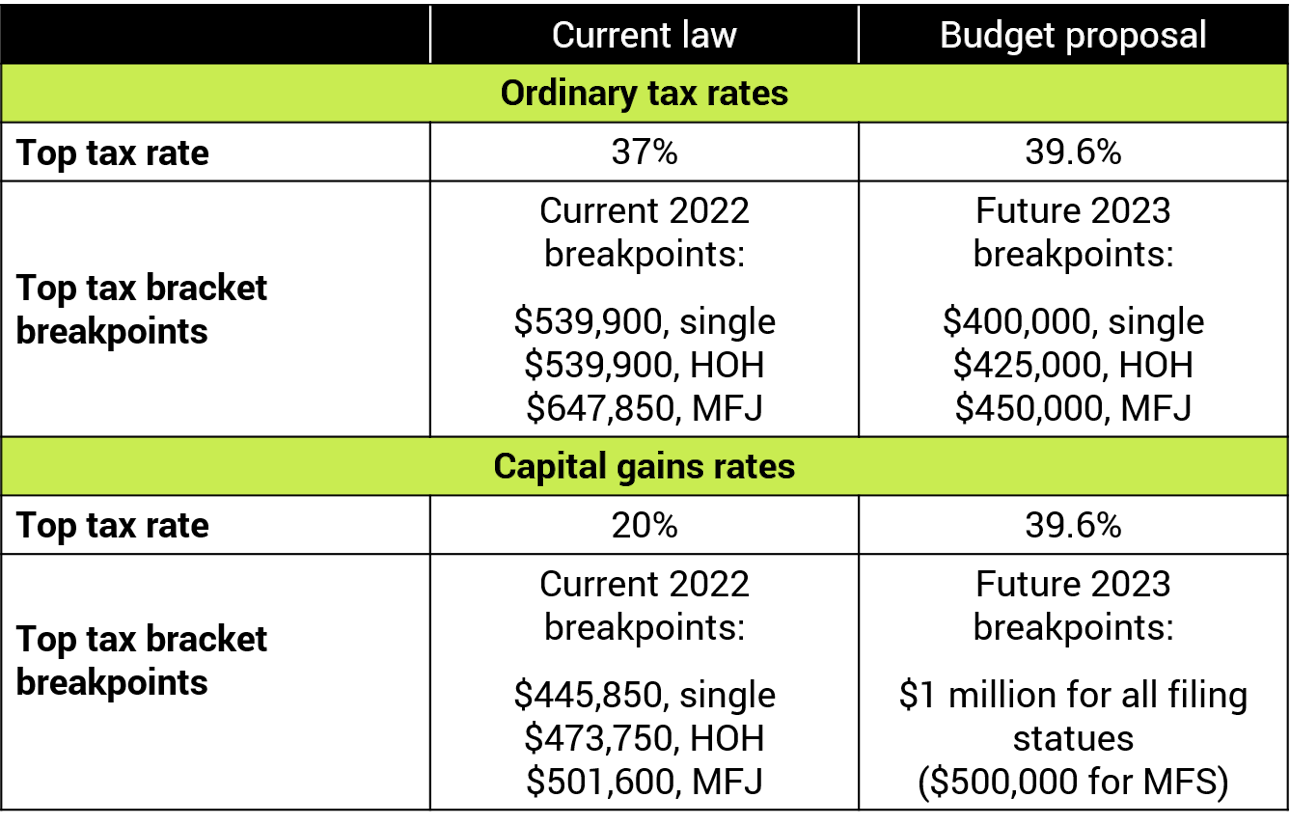

The carried interest loophole is unfair to everyone except the fabulously rich who benefit from it Photograph. The Carried Interest Fairness Act would clarify that this income be subject to ordinary income tax rates rather than the lower capital gains rate. 1639 would treat the grant of carried interest to a general partner as a loan from the limited partners made at a preferred interest rate.

The carried interest loophole allows private equity barons to claim large parts of their compensation for services as investment gains. Absent the carried interest loophole high earning investment managers would otherwise pay up to a 396 tax rate. Politicians from both parties often view carried interest as a tax loophole that overwhelmingly benefits wealthy investors.

There is actually no such thing as the Carried-Interest Loophole. In fact during the 2016 presidential campaign both former-President Donald Trump. Hedge funds have been able to avoid taxation by using carried interest which allows funds to be treated as.

The carried interest rules are yet another tax loophole to allow wealthy private equity and hedge fund managers to avoid paying their fair share of income taxes. Donald Trump claimed the fund managers who availed themselves of this tax break were getting. WASHINGTONTreasury Secretary Steven Mnuchin said the government will act within two weeks to block a hedge-fund maneuver around part of the new tax law.

Carried interest is a share of a private equity or funds profits that serve as compensation for fund managers. Doctors school teachers and police officers all other service providers pay ordinary tax rates on their labor income the salary of hedge fund managers gets special tax treatment a grossly unfair loophole that costs. The proposed Ending the Carried Interest Loophole Act S.

In summary the Carried Interest Fairness Act of 2021 would seek to tax all carried interest allocations at ordinary rates regardless of the character of income determined at the partnership level and only for taxpayers with taxable income exceeding 400000. Its so absurd that politicians on both sides of the aisle agree that it should be closed but its been kept open because of the vast sums of money spent to preserve it. WASHINGTON Fierce lobbying by the private equity industry is.

At the present time changing the tax treatment of carried-interest seems difficult given the political clout of the lucky few who benefit. The lawmakers provided this example. For 100 years since federal taxation of.

During the last presidential election both Donald Trump and Hillary Clinton vowed to end carried interest. The carried-interest loophole Barack Obama said upset the balance between work and wealth. Because its not classified as ordinary income general partners have to pay far less tax than they normally would.

The carried interest tax loophole is the poster child for the corrupting influence of money in politics. They see it as a tax loophole that benefits the rich. Try as one might it is impossible to find a special tax rule that allows Hedge Funds and Hedge Fund managers to take advantage of the US tax code in a way that no other investor can.

Would if enacted tax all or some of carried interest as ordinary income or treat the granting of carried interest as a subsidized loan. Bernstein on carried interest tax break. This same loophole also fuels other predatory investing strategies that originate with private equity and real estate developers.

Carried interest is often the subject of political controversy because many believe it represents income that receives preferential treatment under the US. Kevin LamarqueReuters Tue 14 Dec 2021 0610 EST Last modified on Tue 14 Dec. The carried interest loophole might finally disappear.

Carried Interest In Private Equity Calculations Top Examples Accounting

What Is Passive Income Tax And Are You Paying Too Much Ocean6

What Is The Carried Interest Tax Loophole

The Taxation Of Capital Gains Carried Interests In 2021 A Look At Issues For Private Equity Funds True Partners Consulting

Fact Sheet Close The Carried Interest Loophole That Is A Tax Dodge For Super Rich Private Equity Executives Americans For Financial Reform

Zeonzecl On Twitter Things To Come The Borrowers Handouts

Beyond The Carried Interest Tax Loophole Occasional Links Commentary

Turning Losses Into Tax Advantages

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

What Are Marriage Penalties And Bonuses Tax Policy Center

Carried Interest Calculation Tax Loophole Understanding Pe Vc Youtube

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

Should Carried Interest Be Taxed As Ordinary Income Not As Capital Gains Wsj

How To Tax Capital Without Hurting Investment The Economist

Turning Losses Into Tax Advantages

You Want To Know A Really Dirty Secret Here S Why Democrats Are Protecting Private Equity S Carried Interest Loophole